Introduction

Artificial Intelligence (AI) provides many tools used in most business domains in recent years, and FinTech is no exception. AI is integrated into various financial solutions, from banking applications to crypto wallets. In this article, we’ll discover the benefits of AI in FinTech, examine examples of how the technology is being used, and discuss possible challenges.

How AI Implementation Influences FinTech

Artificial Intelligence represents many tools and technologies that can be used for various purposes in the financial industry. Let’s take a look at some of the major influences of AI on FinTech:

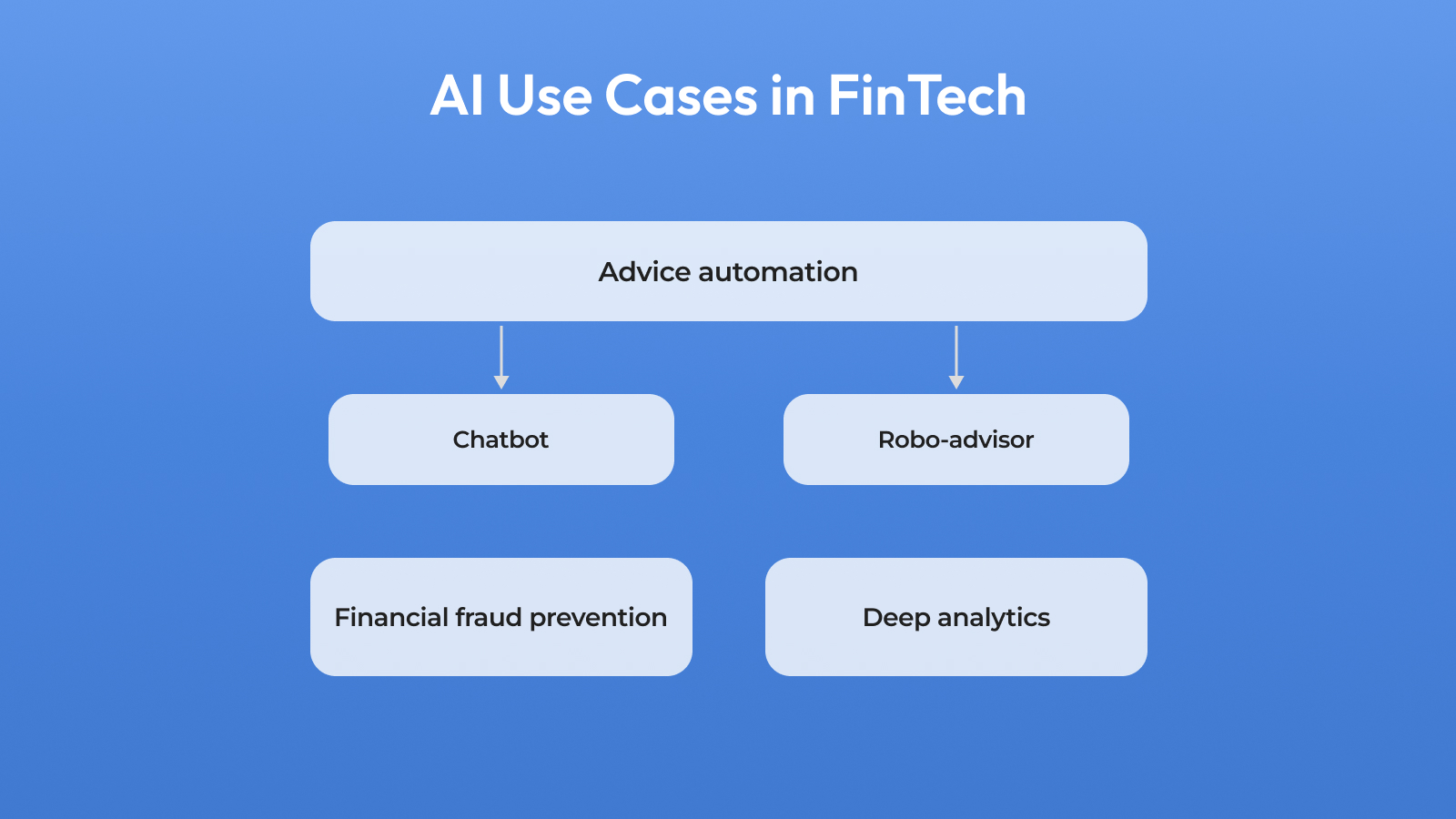

1. Advice automation

Artificial Intelligence can improve customer satisfaction through simple transactions, such as counseling on various issues. AI is an excellent substitute for phone calls and chats with physical employees. Tools used for this purpose include:

- Chatbots: A chatbot is a computer assistant based on Artificial Intelligence that can answer users’ questions and queries, provide them with the requested information (e.g., account status or balance), suggest possible solutions to problems, etc. Chatbot integration allows the replacement of physical employees, which reduces the possibility of human errors. It increases the speed of response and reduces the cost of salaries.

- Robo-advisors: Robo-advisors are a chatbot explicitly designed for the financial industry. They replace a portfolio manager, advising users on their assets’ state and purchase/sale. It helps to assess risks and create an optimal investment strategy.

2. Financial fraud prevention

The digitalization of the financial industry has inevitably led to an increase in fraud and the emergence of new deception schemes. Artificial Intelligence makes it easier to combat this problem in several ways:

- AI algorithms can analyze hundreds of behavior patterns and pick out those that may be suspicious and indicate fraud. The human brain cannot interpret such large amounts of information with such high quality.

- Artificial Intelligence systems can detect fraud any day and at any time. They do not need to rest and are not distracted, which increases the effectiveness of the defense.

- AI remembers each user’s behavior, helping detect suspicious activity and protecting the customer’s account and funds.

3. Deep analytics

Artificial Intelligence can easily and quickly process information and provide concise insights. This capability is often utilized in FinTech, both on the provider and client sides.

For example, AI can analyze revenue-to-expense ratios, showing major categories and providing overall analytics for a selected period. Clients can also gain valuable insights into their assets’ health, value changes, and risk levels.

This feature is handy for investment applications, as it allows users to get comprehensive information on each asset to make informed decisions.

Artificial Intelligence Use Cases in Finance Software

To dive deeper into the topic, let’s take a look at a few real-world examples of how FinTechs are using Artificial Intelligence in some popular financial applications:

1. Wealthfront

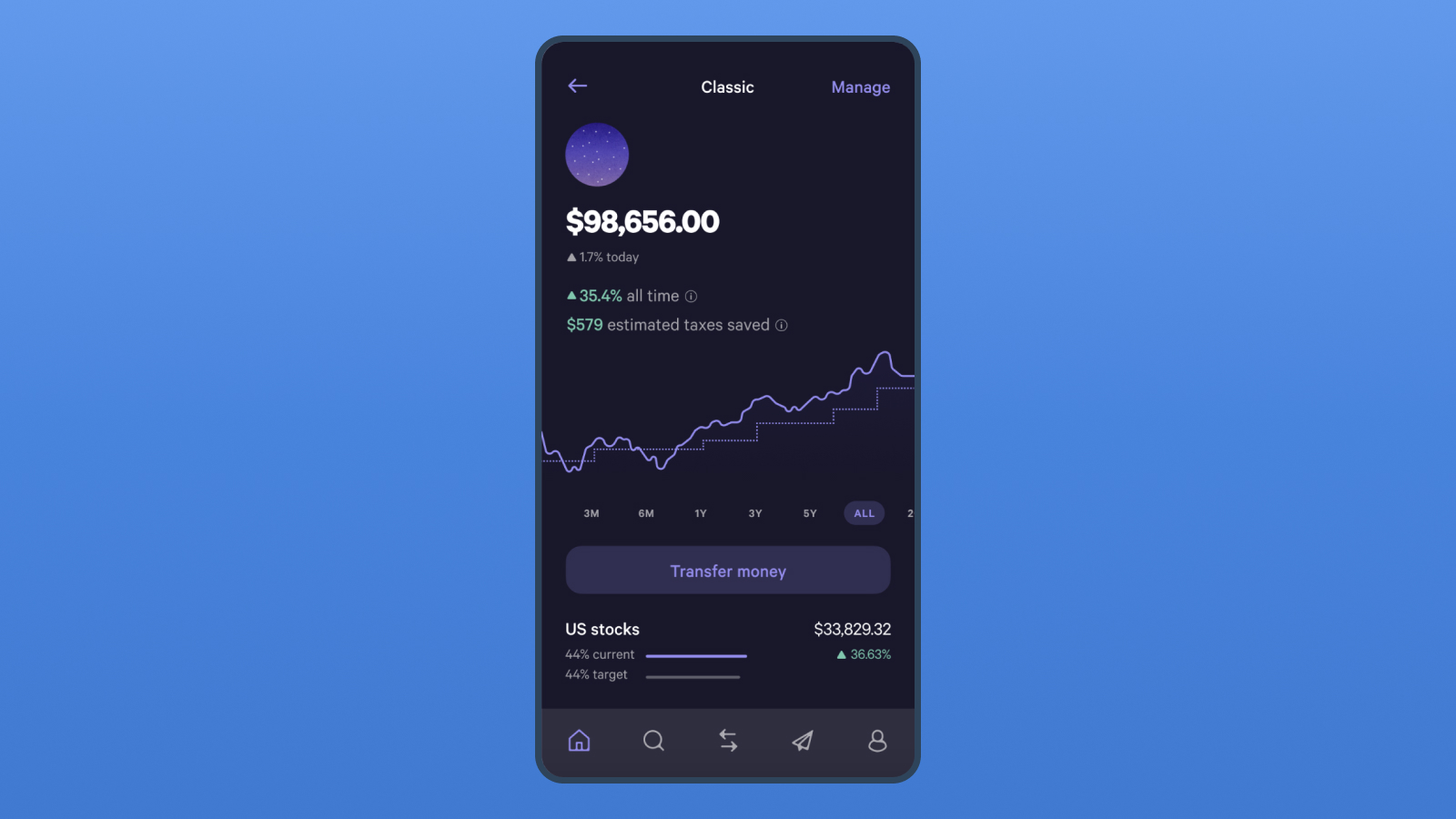

Wealthfront is the largest robo-advisor and an automated investing service. The platform utilizes many rich AI capabilities, including:

- Machine Learning (ML) based automated analytics: These algorithms allow the app to provide investment recommendations personalized to each client’s goals and generate optimal strategies.

- Natural Language Processing (NLP): The NLP technology Wealthfront uses chatbots, which allows them to process human-written text and provide accurate and correct answers to queries.

- Predictive analytics: Wealthfront uses predictive analytics to forecast the development of the market in general and each investment instrument in particular. These models analyze historical data, market indicators, and economic factors to anticipate future developments and make investment decisions based on data on behalf of clients.

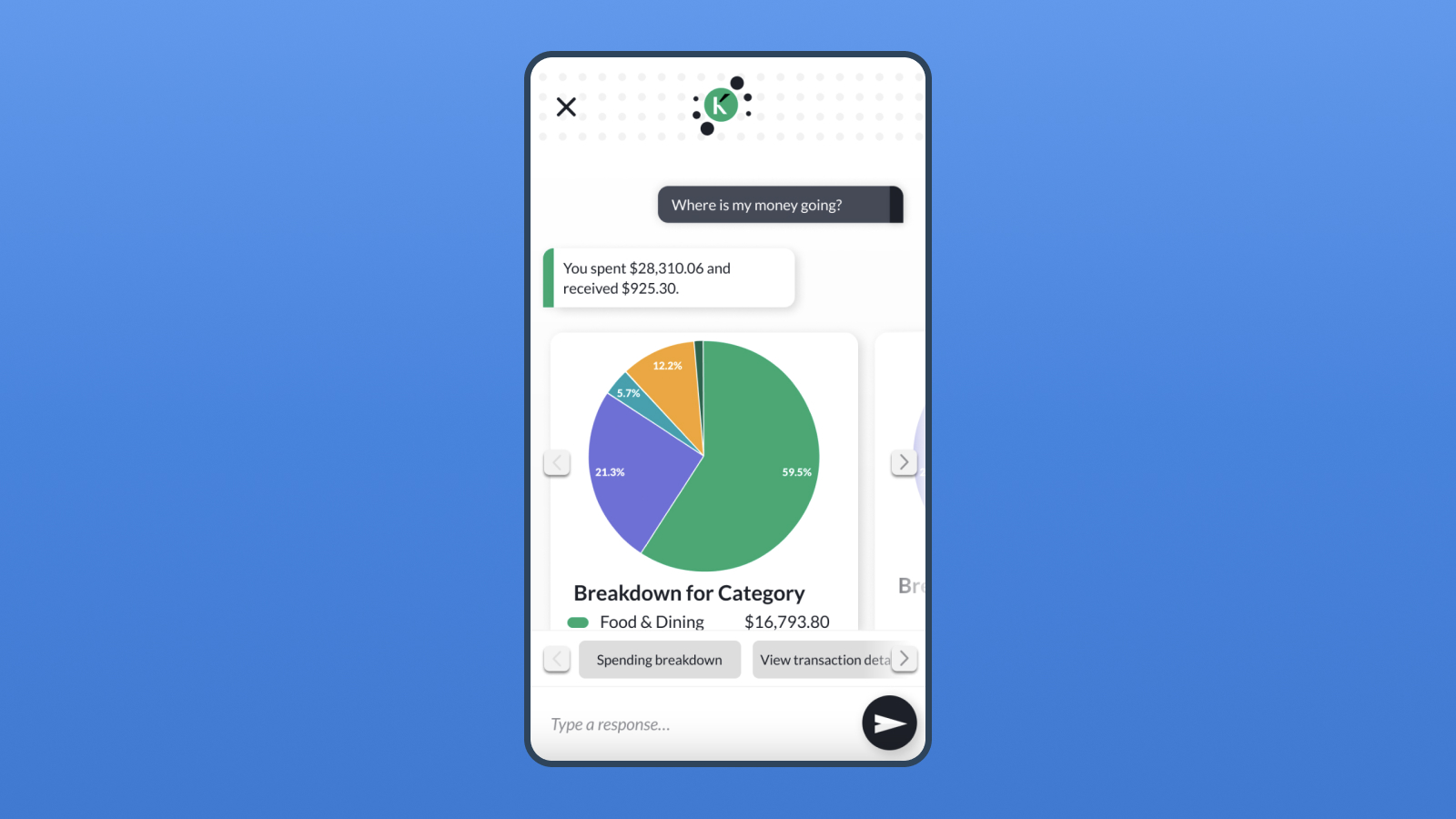

2. Kasisto

Kasisto is a leading provider of conversational AI solutions for financial institutions. It utilizes several AI tools and technologies to power its virtual assistants, including:

- Machine Learning: Machine learning enables continuous improvement of virtual assistants, increasing the speed of their responses and positively impacting the user experience. For the same purpose, the app utilizes NLP technology, which we discussed above.

- Personalization: Kasisto uses Artificial Intelligence-based personalization techniques to tailor responses and recommendations to each user’s unique financial needs, goals, and preferences. Kasisto’s virtual assistants can offer real-time personalized insights, advice, and product recommendations by analyzing user data, transaction history, and behavior.

- Dialog management: Kasisto’s Artificial Intelligence tools include sophisticated dialog management capabilities that enable natural and seamless communication between users and virtual assistants. Dialogue management systems organize interactions, maintain context across multiple conversations, and easily guide users through complex banking processes.

Challenges You May Face Implementing AI in FinTech Solutions

While AI is improving FinTech, its implementation has some challenges. Let’s look at the main possible challenges and how to address them effectively:

1. Inefficient data

Artificial Intelligence systems require large amounts of historical data for training and all relevant data to make compelling predictions.

If your company’s data is hosted in different systems, has various formats, or is lost, AI may have trouble processing it, negatively impacting efficiency.

The solution to this problem is to utilize integrated platforms for data collection, storage, and processing. Such platforms provide unified and structured access to data from different sources.

It allows AI to analyze information and make accurate predictions effectively.

Regularly updating and checking data quality is also essential to prevent errors and distortions in the analysis results.

2. Data leaks

As AI collects large amounts of data in one place (the AI system), there is an additional threat of hackers breaking in and stealing data. This problem can become a severe threat because financial information is sensitive.

To secure your company and customer data, build a banking app with an experienced software provider who can provide your solution with modern and reliable security methods, such as activity tracking, Role-Based Access Control (RBAC), industry-standard data encryption, etc.

3. Regulatory compliance

The FinTech industry is highly regulated, and it is critical to consider this when planning to implement an AI system in your software.

AI algorithms will process a lot of personal data, so ensuring that your system complies with your region’s financial industry regulatory standards is essential.

When choosing a software provider, pay particular attention to their expertise in FinTech development and whether they have experience building solutions that comply with the financial industry’s regulatory standards.

Final Words: Future of AI in FinTech

Artificial Intelligence has already gained a significant role in FinTech, enabling optimization and automation of many basic tasks, improving fraud protection, and providing reliable predictions.

AI branches such as Machine Learning and Natural Language Processing are helping to revolutionize the customizer service. However, this is far from the final stage in developing the interaction between finance and AI.

As interest in Artificial Intelligence grows steadily, we expect rapid technological developments to make the financial industry as efficient as possible in the coming years. It can automate most tasks and bring fraud recognition technology to 100% accuracy.

More Resources:

Utilizing AI Workflow Automation to Revolutionize Your Business

Mobile UI Design with AI: Reimagining the Way Humans and Technology Interact

Yuliya Melnik is a technical writer at Cleveroad, a software development company in Ukraine. She is passionate about innovative technologies that improve the world and loves creating content that evokes vivid emotions.